The Brutal Social Wisdom of Loan Sharks and Army Sergeants

It’s not every day that you get to eavesdrop on a loan shark runner talking about his trade. And when you do, you listen intently without looking like you’re doing so. This was the situation I found myself in while getting a haircut at my local barbershop. As it turns out, what uneducated loan sharks do to enforce repayments in Singapore is exactly what MIT professor Alex Pentland found to be very effective in nudging Bostonians towards exercising more in the winter—social pressure.

The gentleman with dyed hair and a tight fitting football jersey was telling his barber about how runners like him would splash paint not on the doors of the debtors, but on the doors of their neighbours. I thought, somewhat perversely, that’s smart! It’s tough enough being the debtor and getting harassed by loan sharks, but dragging your neighbours and family into your troubles adds significantly more social pressure to the predicament. Another similar tactic loan sharks typically use to leverage social pressure is to scrawl the debtor’s door number with the trademark “O$P$” (a very efficient way of shorthanding “Owe Money, Pay Money”) in a spot where all his neighbours can see, typically near the elevator or staircase of the debtor’s floor.

Sergeants in the Army tap into the same wisdom. Instead of punishing the recruit who didn’t tidy his own bed, why not punish his bunkmates instead? Ask anyone who’s been in the Army, and he/she’ll be able to recount when nine recruits had to drop on the floor for an enforced impromptu workout session while one recruit looks down on the floor sheepishly.

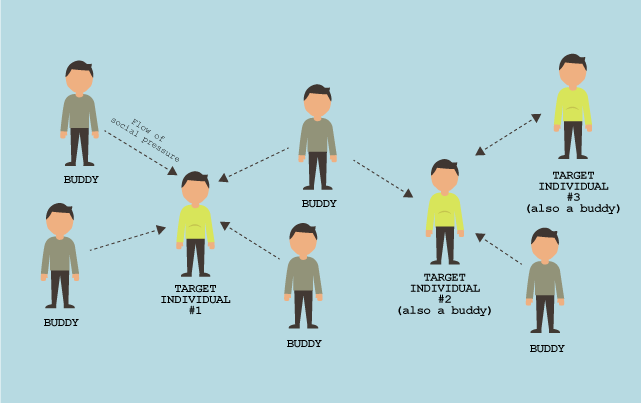

Speaking of getting people to exercise more, Professor Alex Pentland and his then-PhD student Nadav Aharony developed FunFit, an experimental mobile app aimed at nudging people towards increased physical activity. Again, instead of rewarding individuals, the app rewards social groups. As illustrated in the diagram below, “buddies” of the target individual (TI) would be rewarded if the TI reaches a target level of physical activity. The buddies were either people with whom the TIs interacted with extensively, or mere acquaintances. The app proved to be eight times more effective than standard individual-incentive approaches when there was social pressure from people with whom the TIs had extensive interactions with, and four times more effective than individual-incentive approaches when it involved mere acquaintances.

The fact that close friends and family can exert more social pressure on you than acquaintances do is an obvious but potentially useful one. Going back to the example of loan shark runners splashing paint on a debtor’s neighbour’s door, it’s interesting to note how the social pressure exerted on the debtor roughly equates to pressure from all neighbours plus pressure from his family plus pressure from all neighbours multiplied by every member of the debtor’s family. With such cutthroat manipulation of a human being’s instinctive need to coexist peacefully within a community and desire for status (or “face”), it’s no wonder that many debtors end up resorting to suicide.

That does bring up an ethical concern to using social pressure to nudge—can there be too much social pressure that ends up not only affecting the permanent well-being of the target audience, but also result in the nudger not achieving its goals? Organisational empathy and a reasonable cost-benefit analysis process are certainly required when applying social pressure to influence target audiences.

Another issue worth thinking about is if the social incentive should be rooted in loss or gain. The loan shark and sergeant examples are definitely loss-based, which, in theory, are more effective due to people’s generally greater sensitivity to losses than to gains. However, public and private organisations alike will find loss-based incentives harder to implement, not least due to the public negativity that can potentially be generated and amplified via social media. Regardless, the significant improvement in effectiveness via gain-based incentive, as exemplified in the FunFit experiment, is still certainly worth considering when your organisation wishes to influence its target audiences towards certain behaviours.

Thumbnail image of the paint-splashed door was sourced from All Singapore Stuff.